- Análisis

- Principales Ganadores/Perdedores

Top Gainers and Losers: Australian dollar and US dollar

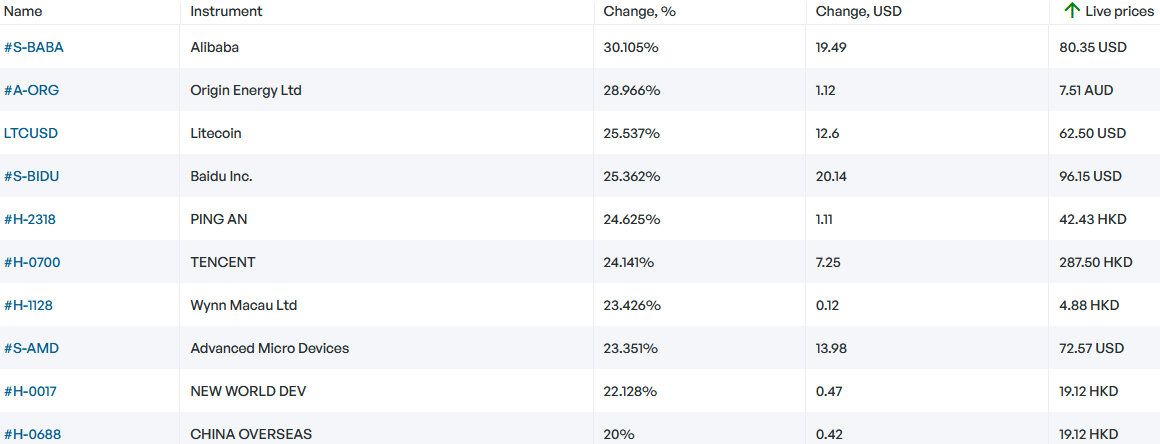

Top Gainers - global market

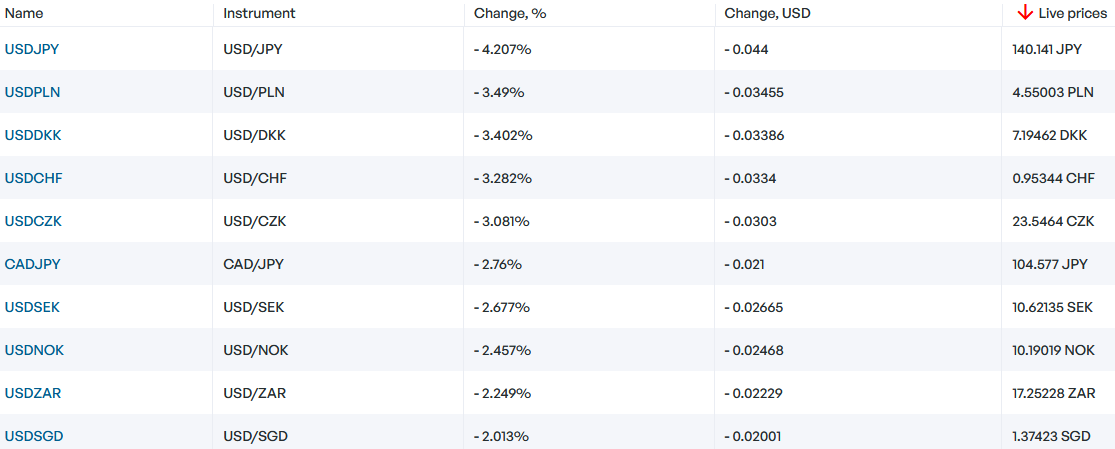

Over the past 7 days, the US dollar index has not changed much. It is possible that the activity of market participants has decreased before the Thanksgiving Day in the US, which will be on November 24th. Nevertheless, we can note the weakening of the US dollar against certain currencies due to investors' expectations that the Fed rate will slow down its growth and is unlikely to exceed 5%. The strengthening of the Australian dollar was facilitated by good data on the labor market in October and a decrease in the Australia Unemployment Rate to 3.4%. The New Zealand dollar strengthened on the decline of the New Zealand Producer Price Index (PPI) in the 3rd quarter. The Swiss franc strengthened on strong foreign trade performance in October and growth in Switzerland Industrial Production in Q3 2022.

1. Origin Energy Ltd, +29% – Australian Energy Company

2. Alibaba Group HLDG LTD, +30.1% – Chinese Online Store

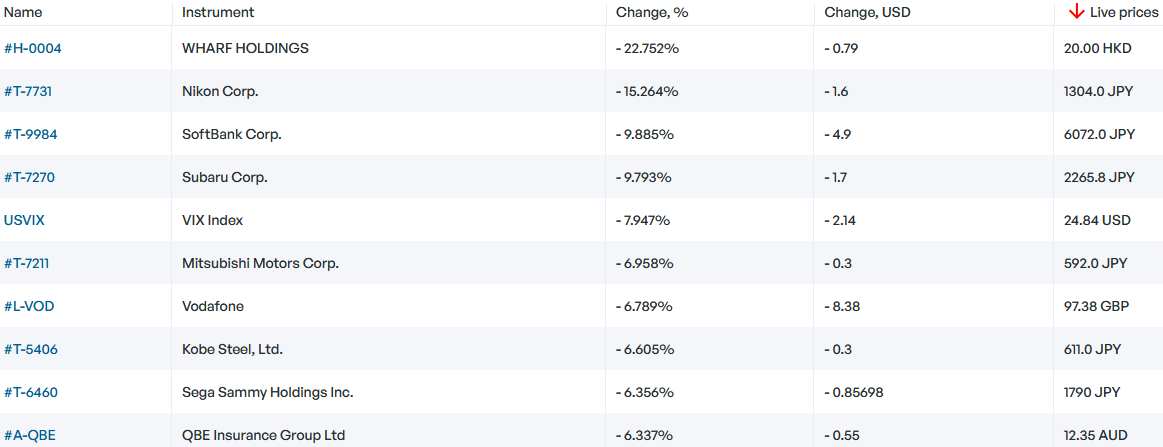

Top Losers - global market

1. Wharf (Holdings) Limited – Hong Kong development and logistics company

2. Nikon Corporation – Japanese manufacturer of photo and video equipment, medical devices, measuring equipment and more.

Top Gainers - foreign exchange market (Forex)

1. GBPUSD, NZDUSD - the growth of these charts means the strengthening of the British pound and the New Zealand dollar against the US dollar.

2. AUDUSD, EURTRY - the growth of these graphs means the weakening of the US dollar and the Turkish lira against the Australian dollar and the euro.

Top Losers - foreign exchange market (Forex)

1. USDDKK, USDCHF - the decline of these graphs means the weakening of the US dollar against the Danish krone and the Swiss franc.

2. USDPLN, USDJPY - the decline of these graphs means the strengthening of the Polish zloty and the Japanese yen against the US dollar.

Nueva herramienta analítica exclusiva

Cualquier rango de fechas - de 1 día a 1 año

Cualquier grupo de trading: Forex, Acciones, Índices, etc.

Nota:

Este resumen tiene carácter informativo-educativo y se publica de forma gratuita. Todos los datos que contiene este resumen, son obtenidos de fuentes públicas que se consideran más o menos fiables. Además, no hay niguna garantía de que la información sea completa y exacta. En el futuro, los resúmenes no se actualizarán. Toda la información en cada resumen, incluyendo las opiniones, indicadores, gráficos y todo lo demás, se proporciona sólo para la observación y no se considera como un consejo o una recomendación financiera. Todo el texto y cualquier parte suya, así como los gráficos no pueden considerarse como una oferta para realizar alguna transacción con cualquier activo. La compañía IFC Markets y sus empleados en cualquier circunstancia no son responsables de ninguna acción tomada por otra persona durante o después de la observación del resumen.

Anterior Top Ganadores y Perdedores

Over the past 7 days, the American dollar has remained almost unchanged. According to the CME FedWatch tool, there is an 89% probability of the U.S. Federal Reserve raising interest rates at the meeting on July 26th. The Swiss franc has strengthened due to positive economic indicators such as Credit...

Durante los últimos 7 días, el índice del dólar estadounidense ha disminuido. Como era de esperar, la Reserva Federal (Fed) mantuvo su tasa de interés en 5,25% durante la reunión del 14 de junio. Ahora, los inversores están monitoreando las estadísticas económicas y tratando de pronosticar el...

Durante los últimos 7 días, el índice del dólar estadounidense no ha cambiado mucho. Ha estado cotizando en un rango estrecho de 103,2-104,4 puntos por cuarta semana. Los inversores esperan el resultado de la reunión de la Fed del 14 de junio. Las acciones de Tesla subieron por la apertura de nuevas...