- Análisis

- Principales Ganadores/Perdedores

Top Gainers and Losers: the British pound and the American dollar

Top Gainers - global market

Top Gainers - global market

Over the past 7 days, the US dollar index has slightly decreased. After difficulties in the US banking system due to the possible bankruptcy of Silicon Valley Bank and Signature Bank, investors do not rule out a slowdown in the pace of the Federal Reserve System's (FRS) rate hike. According to CME FedWatch, the probability of a 0.25% increase in the rate is approximately 75% at the next Fed meeting on March 22. Previously, a 0.5% increase was expected, but this option is not even considered by forex market participants. The probability of the FRS keeping the interest rate at its current level of 4.75% is estimated at 25%. This has increased investors' interest in gold. The British pound strengthened in anticipation of a Bank of England rate hike to 4.25% from the current level of 4% at the meeting on March 23. The yen was supported by good economic statistics. Japan's trade balance deficit in February shrank to its lowest level since April 2022.

1. Gold vs Light Sweet Crude Oil (WTI), +18.4% – gold instrument: gold vs US oil

2. USVIX, +17.4% – VIX index (CBOE volatility index)

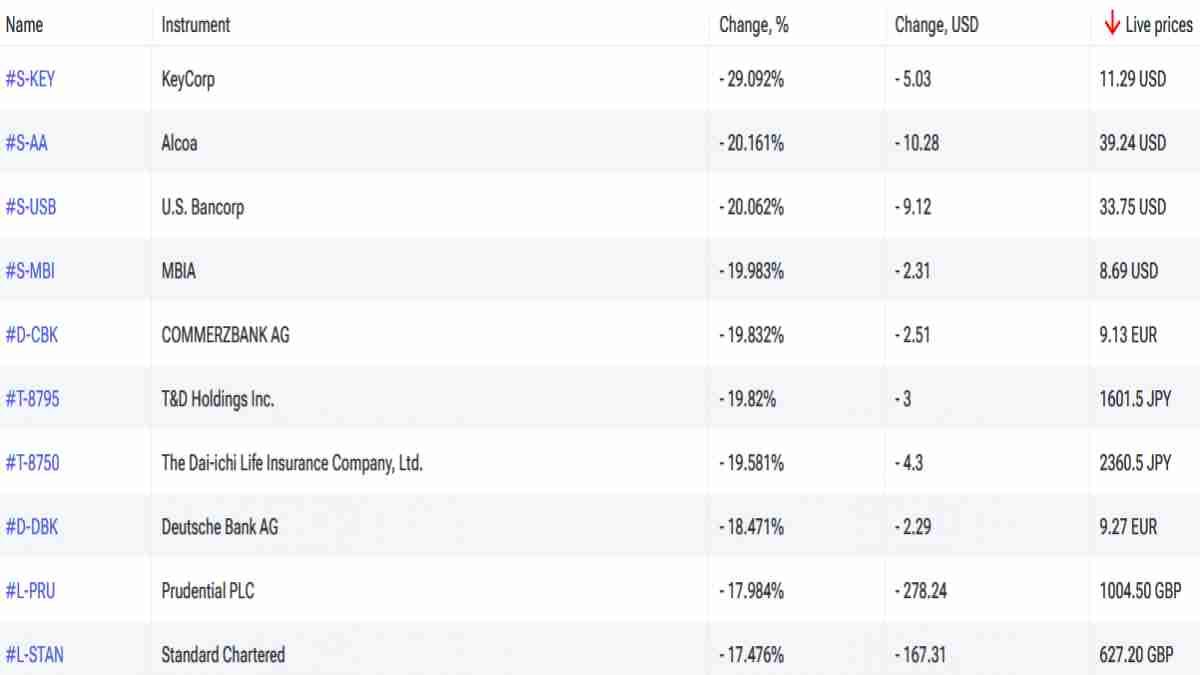

Top Losers - global market

Top Losers - global market

1. KeyCorp – American bank and financial holding.

2. Alcoa Corp. – American aluminum producer.

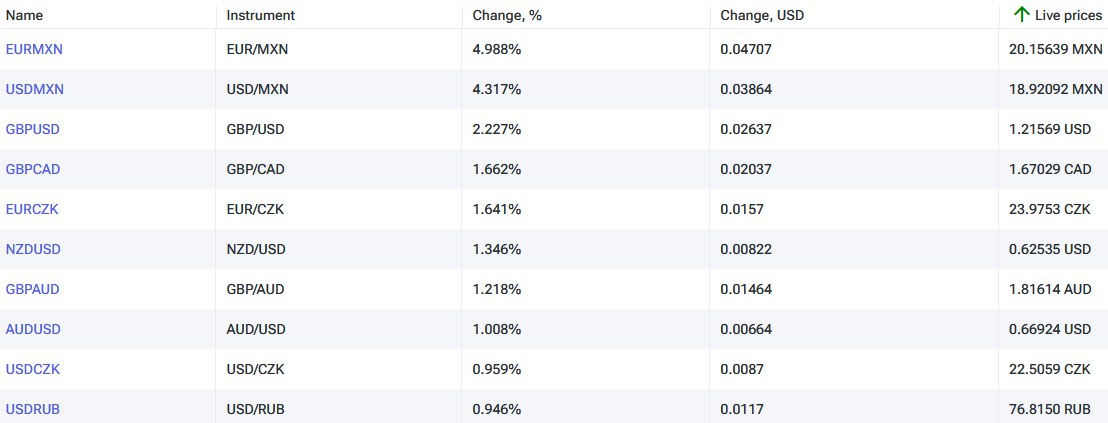

Top Gainers - foreign exchange market

Top Gainers - foreign exchange market

1. USDMXN, EURMXN - the growth of these charts means the strengthening of the US dollar and euro against the Mexican peso.

2. GBPUSD, GBPCAD - the growth of these charts means the weakening of the US and Canadian dollars against the British pound.

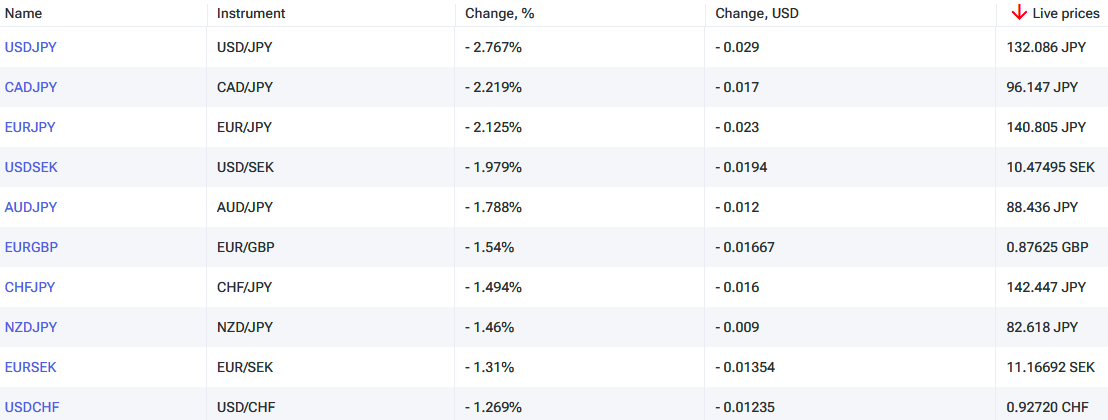

Top Losers - foreign exchange market (Forex)

Top Losers - foreign exchange market (Forex)

1. CADJPY, EURJPY - the decline of these charts means the weakening of the Canadian dollar and the euro against the Japanese yen.

2. USDJPY, USDSEK - the decline of these charts means the strengthening of the Japanese yen and the Swedish krona against the US dollar.

Nueva herramienta analítica exclusiva

Cualquier rango de fechas - de 1 día a 1 año

Cualquier grupo de trading: Forex, Acciones, Índices, etc.

Nota:

Este resumen tiene carácter informativo-educativo y se publica de forma gratuita. Todos los datos que contiene este resumen, son obtenidos de fuentes públicas que se consideran más o menos fiables. Además, no hay niguna garantía de que la información sea completa y exacta. En el futuro, los resúmenes no se actualizarán. Toda la información en cada resumen, incluyendo las opiniones, indicadores, gráficos y todo lo demás, se proporciona sólo para la observación y no se considera como un consejo o una recomendación financiera. Todo el texto y cualquier parte suya, así como los gráficos no pueden considerarse como una oferta para realizar alguna transacción con cualquier activo. La compañía IFC Markets y sus empleados en cualquier circunstancia no son responsables de ninguna acción tomada por otra persona durante o después de la observación del resumen.

Anterior Top Ganadores y Perdedores

Over the past 7 days, the American dollar has remained almost unchanged. According to the CME FedWatch tool, there is an 89% probability of the U.S. Federal Reserve raising interest rates at the meeting on July 26th. The Swiss franc has strengthened due to positive economic indicators such as Credit...

Durante los últimos 7 días, el índice del dólar estadounidense ha disminuido. Como era de esperar, la Reserva Federal (Fed) mantuvo su tasa de interés en 5,25% durante la reunión del 14 de junio. Ahora, los inversores están monitoreando las estadísticas económicas y tratando de pronosticar el...

Durante los últimos 7 días, el índice del dólar estadounidense no ha cambiado mucho. Ha estado cotizando en un rango estrecho de 103,2-104,4 puntos por cuarta semana. Los inversores esperan el resultado de la reunión de la Fed del 14 de junio. Las acciones de Tesla subieron por la apertura de nuevas...