- Análisis

- Principales Ganadores/Perdedores

Top Gainers and Losers: British Pound and Mexican Peso

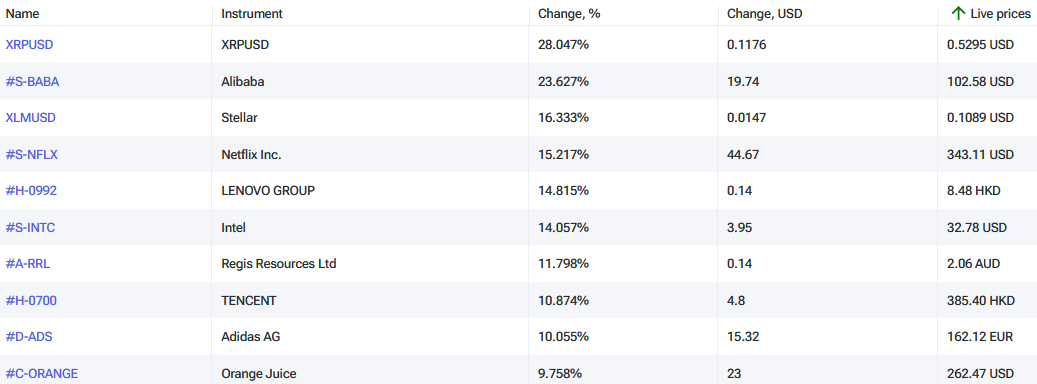

Top Gainers - global market

Top Gainers - global market

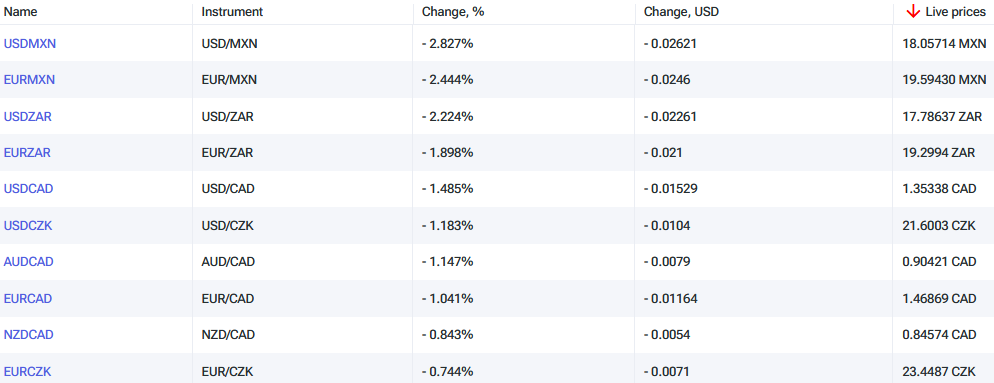

Over the past 7 days, the US dollar index continued to decline but failed to update the previous week's minimum. A slowdown in the decline can be noted. Preliminary data for the first quarter of 2023 showed that the US dollar index fell by -1.3%. In the fourth quarter of 2022, its decline was much greater and amounted to -7.7%. The strengthening of the Mexican peso was due to the Bank of Mexico raising its rate from 11% to 11.25%. This happened despite a decrease in Mexican inflation in February to +7.62% y/y, the lowest level since March 2022. The strengthening of the South African rand was due to the South African Reserve Bank raising its rate from 7.25% to 7.75%. This level is higher than South African inflation in February, which was +7% y/y. The strengthening of the British pound was due to UK GDP growth in the fourth quarter of 2022, which was +0.6% y/y. This was better than expected (+0.4%). The Japanese yen weakened against the backdrop of the risks of high inflation. In March, the Tokyo Consumer Price Index grew by +3.3% y/y, higher than expected (+2.7%).

1. XRPUSD, +28% – Cryptocurrency Ripple (XRP)

2. Alibaba Group, +23.6% – Chinese online store

Top Losers - global market

Top Losers - global market

1. VIX Index – CFD on CBOE Volatility Index

2. Fosun International Limited – Hong Kong multi profile holding.

Top Gainers - foreign exchange market (Forex)

Top Gainers - foreign exchange market (Forex)

1. CADJPY, NZDJPY - the growth of these charts means the strengthening of the Canadian and New Zealand dollars against the Japanese yen.

2. GBPJPY, GBPSEK - the growth of these charts means the weakening of the Japanese yen and the Swedish krona against the British pound.

Top Losers - foreign exchange market (Forex)

Top Losers - foreign exchange market (Forex)

1. USDMXN, EURMXN - the decline of these charts means the weakening of the US dollar and the euro against the Mexican peso.

2. USDZAR, EURZAR - the decline of these charts means the strengthening of the South African rand against the US dollar and the euro.

Nueva herramienta analítica exclusiva

Cualquier rango de fechas - de 1 día a 1 año

Cualquier grupo de trading: Forex, Acciones, Índices, etc.

Nota:

Este resumen tiene carácter informativo-educativo y se publica de forma gratuita. Todos los datos que contiene este resumen, son obtenidos de fuentes públicas que se consideran más o menos fiables. Además, no hay niguna garantía de que la información sea completa y exacta. En el futuro, los resúmenes no se actualizarán. Toda la información en cada resumen, incluyendo las opiniones, indicadores, gráficos y todo lo demás, se proporciona sólo para la observación y no se considera como un consejo o una recomendación financiera. Todo el texto y cualquier parte suya, así como los gráficos no pueden considerarse como una oferta para realizar alguna transacción con cualquier activo. La compañía IFC Markets y sus empleados en cualquier circunstancia no son responsables de ninguna acción tomada por otra persona durante o después de la observación del resumen.

Anterior Top Ganadores y Perdedores

Over the past 7 days, the American dollar has remained almost unchanged. According to the CME FedWatch tool, there is an 89% probability of the U.S. Federal Reserve raising interest rates at the meeting on July 26th. The Swiss franc has strengthened due to positive economic indicators such as Credit...

Durante los últimos 7 días, el índice del dólar estadounidense ha disminuido. Como era de esperar, la Reserva Federal (Fed) mantuvo su tasa de interés en 5,25% durante la reunión del 14 de junio. Ahora, los inversores están monitoreando las estadísticas económicas y tratando de pronosticar el...

Durante los últimos 7 días, el índice del dólar estadounidense no ha cambiado mucho. Ha estado cotizando en un rango estrecho de 103,2-104,4 puntos por cuarta semana. Los inversores esperan el resultado de la reunión de la Fed del 14 de junio. Las acciones de Tesla subieron por la apertura de nuevas...