- Análisis

- Análisis Técnico

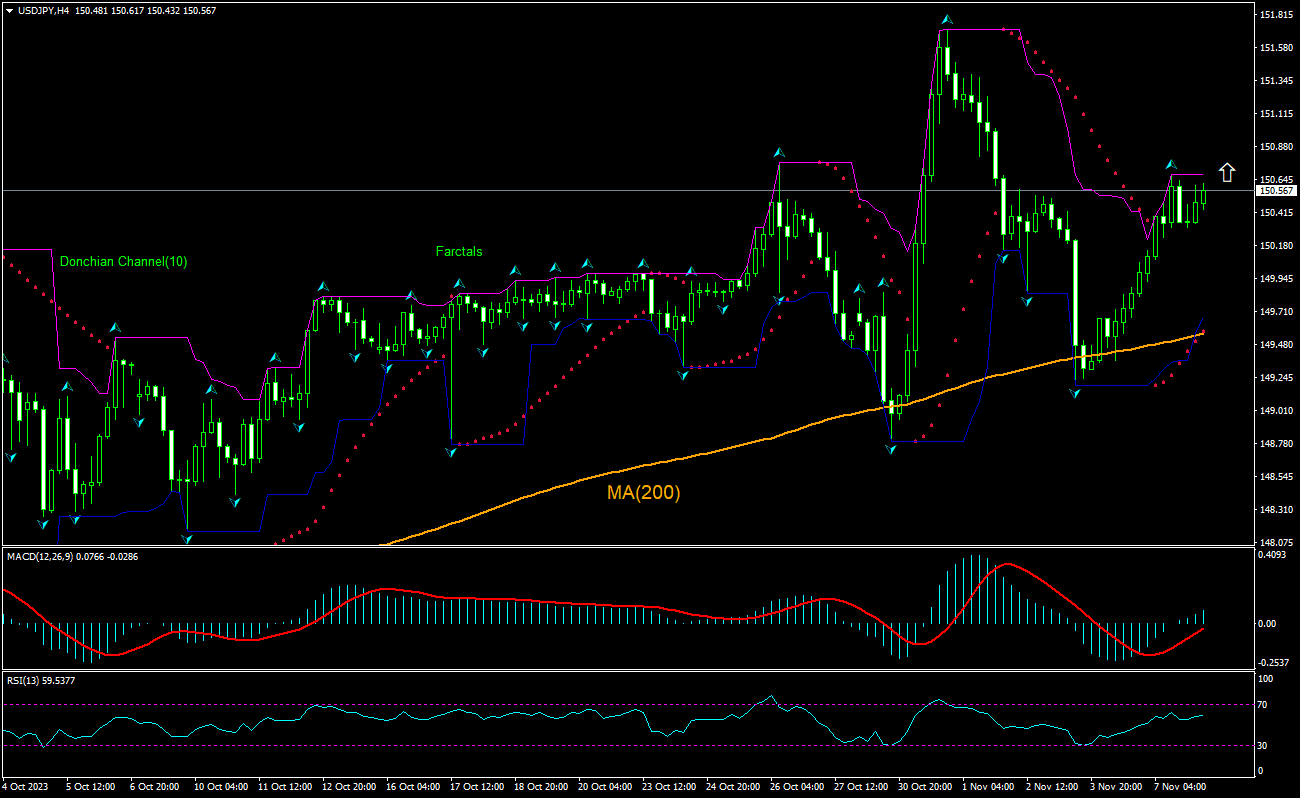

USD/JPY Análisis Técnico - USD/JPY Trading: 2023-11-08

USD/JPY Resumen de análisis técnico

Por encima de 150.69

Buy Stop

Por debajo de 149.57

Stop Loss

| Indicador | Señal |

| RSI | Neutral |

| MACD | Comprar |

| Donchian Channel | Comprar |

| MA(200) | Comprar |

| Fractals | Neutral |

| Parabolic SAR | Comprar |

USD/JPY Análisis gráfico

USD/JPY Análisis técnico

The USDJPY technical analysis of the price chart on 4-hour timeframe shows USDJPY,H4 is rebounding after testing the 200-period moving average MA(200) five days ago. We believe the bullish momentum will continue after the price breaches above the upper bound of the Donchian channel at 150.69. A level above this can be used as an entry point for placing a pending order to buy. The stop loss can be placed below 149.57. After placing the order, the stop loss is to be moved to the next fractal low indicator, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level without reaching the order, we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Análisis fundamental de Forex - USD/JPY

Japan’s household spending continued to decline in September. Will the USDJPY price rebound persist?

Japan’s household spending continued to decline in September: the Statistics Bureau reported Household Spending fell 2.8% over year in September after 2.5% drop in August when 3.0% decline was expected. It was the seventh consecutive monthly fall against the backdrop of rising prices as real wages continue to slide and people cut back spending on food and other items. The Ministry of Health, Labor and Welfare reported real, inflation-adjusted Average Cash Earnings fell 2.4% over year in September, the eighteenth straight monthly fall. Falling Japanese household spending is bearish for yen and bullish for USDJPY. Similarly falling Japanese workers’ wages is bearish for yen and bullish for USDJPY.

Nota:

Este resumen tiene carácter informativo-educativo y se publica de forma gratuita. Todos los datos que contiene este resumen, son obtenidos de fuentes públicas que se consideran más o menos fiables. Además, no hay niguna garantía de que la información sea completa y exacta. En el futuro, los resúmenes no se actualizarán. Toda la información en cada resumen, incluyendo las opiniones, indicadores, gráficos y todo lo demás, se proporciona sólo para la observación y no se considera como un consejo o una recomendación financiera. Todo el texto y cualquier parte suya, así como los gráficos no pueden considerarse como una oferta para realizar alguna transacción con cualquier activo. La compañía IFC Markets y sus empleados en cualquier circunstancia no son responsables de ninguna acción tomada por otra persona durante o después de la observación del resumen.