- Análisis

- Análisis Técnico

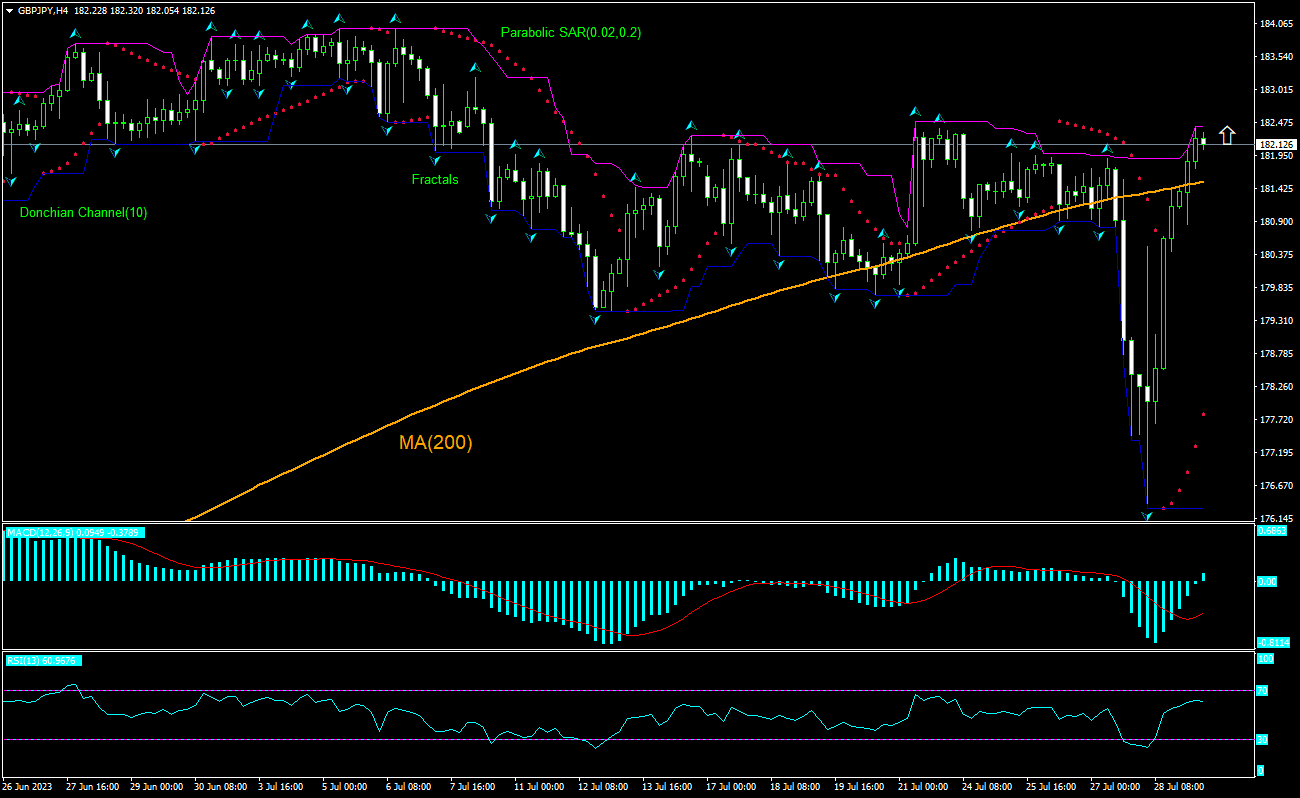

GBP/JPY Análisis Técnico - GBP/JPY Trading: 2023-07-31

GBP/JPY Resumen de análisis técnico

Por encima de 182.41

Buy Stop

Por debajo de 180.68

Stop Loss

| Indicador | Señal |

| RSI | Neutral |

| MACD | Comprar |

| Donchian Channel | Neutral |

| MA(200) | Comprar |

| Fractals | Neutral |

| Parabolic SAR | Comprar |

GBP/JPY Análisis gráfico

GBP/JPY Análisis técnico

The GBPJPY technical analysis of the price chart on 4-hour timeframe shows GBPJPY,H4 has breached again above the 200-period moving average MA(200) which is rising still. We believe the bullish momentum will continue after the price breaches above the upper bound of the Donchian channel at 182.41. A level above this can be used as an entry point for placing a pending order to buy. The stop loss can be placed above 180.68. After placing the order, the stop loss is to be moved to the next fractal low indicator, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level without reaching the order, we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Análisis fundamental de Forex - GBP/JPY

UK private sector activity growth continued slowing in July. Will the GBPJPY price rebounding reverse?

Recent UK data were weak on balance. Private sector activity growth continued slowing in July. SP Global reported a week ago UK Composite PMI declined to 50.7 – six month low, from 51.5 in June. The decline was largely due to flatlining new orders and sharply reduced backlogs of work. New business volumes stalled in July, thereby ending a five-month period of expansion. Marginal growth in the service economy was offset by falling manufacturing sales. Slowing of UK private sector activity expansion is bearish for Pound and GBPJPY pair. On the other hand, data from Japanese METI showed retail sales rose in June in line with expectations: retail sales in Japan grew 5.9% over year in June, accelerating slightly from an upwardly revised 5.8% increase in May. This was the 16th consecutive month of expansion in retail trade as consumption continued to recover from the pandemic-induced slump. Rebounding Japanese retail sales is bullish form Japanese yen and bearish for GBPJPY. However, current setup is bullish for GBPJPY pair.

Explore nuestras

Condiciones de Trading

- Spreads desde 0.0 pip

- 30,000+ Instrumentos de Trading

- Ejecución Instantánea

¿Listo para Operar?

Abrir Cuenta Nota:

Este resumen tiene carácter informativo-educativo y se publica de forma gratuita. Todos los datos que contiene este resumen, son obtenidos de fuentes públicas que se consideran más o menos fiables. Además, no hay niguna garantía de que la información sea completa y exacta. En el futuro, los resúmenes no se actualizarán. Toda la información en cada resumen, incluyendo las opiniones, indicadores, gráficos y todo lo demás, se proporciona sólo para la observación y no se considera como un consejo o una recomendación financiera. Todo el texto y cualquier parte suya, así como los gráficos no pueden considerarse como una oferta para realizar alguna transacción con cualquier activo. La compañía IFC Markets y sus empleados en cualquier circunstancia no son responsables de ninguna acción tomada por otra persona durante o después de la observación del resumen.